Are you willing to start your career as a financial analyst? Let me guide you with job roles, salaries, and available career opportunities.

Are you willing to start your career as a financial analyst? Let me guide you with job roles, salaries, and available career opportunities. Let’s jump into everything you need to know about financial analysts.

Before getting complete details about a career as a financial analyst, one must know who is a financial analyst.

Table of Contents

Who is a financial analyst?

Financial analysis is a person who digs into financial data and uses their findings and research into various investment decisions. A financial analyst must know about changing market trends and prepare financial models accordingly. They guide their clients on when to buy and sell investments with the help of their research and skills.

Often they provide reports and explain their expertise or communicate their opinion through public and financial media.

Why choose financial analysis as a career?

Firstly, you can opt to be a financial analyst as it will provide you with a sizeable paycheck, prestige, influence, benefit, stable growth and opportunities. There are three main reasons to select your career as a financial analyst.

- More Job Opportunities: Increasing growth and development of new products in the financial market have provided long-term job prospects for financial analysts. As per the US government estimates, there will be a growth of 6% in the career of financial analysts in terms of new job openings and advancement of existing opportunities in the US from 2020 to 2030. In India, the growth and demand are even more.

- Stable growth: Despite a fear of economic crises due to changes and the development of market trends, there will be demand for a financial analyst. This demand will provide stable growth and opportunities. According to a survey by the bureau, in India, there will be a growth of 11% in employment opportunities for financial analysts by 2026.

- Good pay scale: A good pay scale is the most important reason to select a career as a financial analyst. With constant development and innovation in the market, demand for financial analysts is rapidly increasing. Naturally, this will make it possible for an organisation offers a handsome package to a financial analyst.

Role of Financial Analyst

Corporations or organisations hire financial analysts to build wealth from money. The primary role of a financial analyst is to dig into financial data and identify opportunities or evaluate outcomes for business decisions or intelligent investment recommendations.

Generally, A financial analyst studies demographic factors, marketplace trends and microeconomic factors to find investment opportunities and predict the market to reduce the negative impact on the organisation.

Besides, a financial analyst also provides a suggestion for new issue shares, issuing their bonds, splitting stocks and other this kind of matters.

In short, a financial analyst looks at where and how a company has invested its resources and what will be the future position or value of this investment. An analyst not only pays attention to investment but also looks deeply at the impact of this investment on companies’ long-term and short-term growth.

An analyst also suggests various ways during the economic downstream to reduce its effect on a company’s growth and wealth. In the franchise business model, a financial analyst tracks individual franchises or groups within a geographic location.

The role of financial analysts is not limited to only research about shares, bonds or securities. Besides, a financial analyst uses numerical financial data to pinpoint various marketing techniques related to cost.

Financial analysts focus on investment recommendations, and for that, they emphasise equity and credit markets. This may include evaluating financial data, checking market trends, examining market events, examining financial statements, creating financial models, monitoring macroeconomic trends, focusing on specific industries or sectors etc.

How to be a financial analyst?

In the journey of financial analysis, one needs to develop core competencies that can grow with education and specific certified courses. Here I am sharing a step-by-step guide to start your career as a financial analyst.

Step 1: Get a bachelor’s degree

Firstly, You need a bachelor’s degree in finance, accounting, economics or related fields to enter this field. With the help of this degree, one can start his entry-level job as a financial analyst.

Step 2: Get certified

One must pursue CFA certificates to work in elite companies on a middle level. As CFA is a global certificate designated by the CFA Institute, many aspirants are making it diverse and more competitive. This course includes three levels with a duration of 1.5 years to 4 years.

Eligibility criteria for CFA certification;

- Have a bachelor’s or equivalent degree in finance or a related field,

- have work experience of four years in the finance-related sector

- or work experience of 4000 hours, along with reference letters from two CFA professional

Moreover, along with prestige and lucrative growth, CFA provides vital networking. This will help you in building your career as a financial analyst.

Step 3: Advance your knowledge and skills

Now you can take a specialised course in your selected field to understand it more deeply. To enhance your critical thinking skills, one can pursue a master’s degree in business or finance. This will also accelerate your resume.

Additionally, one can opt for a CFA certificate after finishing MBA in finance. Generally, this will give you a better understanding of the finance and investment sector and strong networking.

Step 4: Obtain an Internship

Many colleges offer an internship programme. This programme will develop the required skill to start your career as a financial analyst. Moreover, this programme will make you aware of the practical scenario of a market. It is also possible that your good performance makes it possible for your internship provider offers you a full-time job.

Moreover, to be a successful career as a financial analyst, financial analysts must have relevant expertise in advanced planning methods and up-to-date knowledge about wealth management. An internship programme can equip you with this thing quickly.

Step 5: Prepare a resume that highlights your skills

Now you need to create a perfect resume to start your career as a financial analyst. Your resume must highlight your degrees and certificates as well as your skills. Additionally, most companies look for a candidate with practical knowledge, experience, and a good track record.

Now you need to apply to all relevant job providers. It is advisable to alter your resume according to the specific employer instead of a generic resume. This will make you a more desirable candidate.

Working as Financial Analyst

A perfect place to start your career as a financial analyst is in companies that deal with investments. However, one can opt to work in a wide range of industries capable of the requirement of a financial analyst.

Usually, employment opportunities offered to a financial analyst are investment banks, private equity groups, venture capital firms, government agencies, private ventures, mutual fund companies, insurance companies, pension funds or similar kinds of organisations.

Multinational banks, financial institutions, RBI (Reserve Bank of India), the Industrial & Development Bank of India, stockbroking firms, insurance companies, and finance and leasing companies are some of the top employers for financial analysts.

Salary of a Financial Analyst

A lucrative career option in financial analysis is judged by pay scale. Generally, salary is based on experience and the company’s location under whom you are working. Highly experienced people working in elite companies are offered by good pay scale.

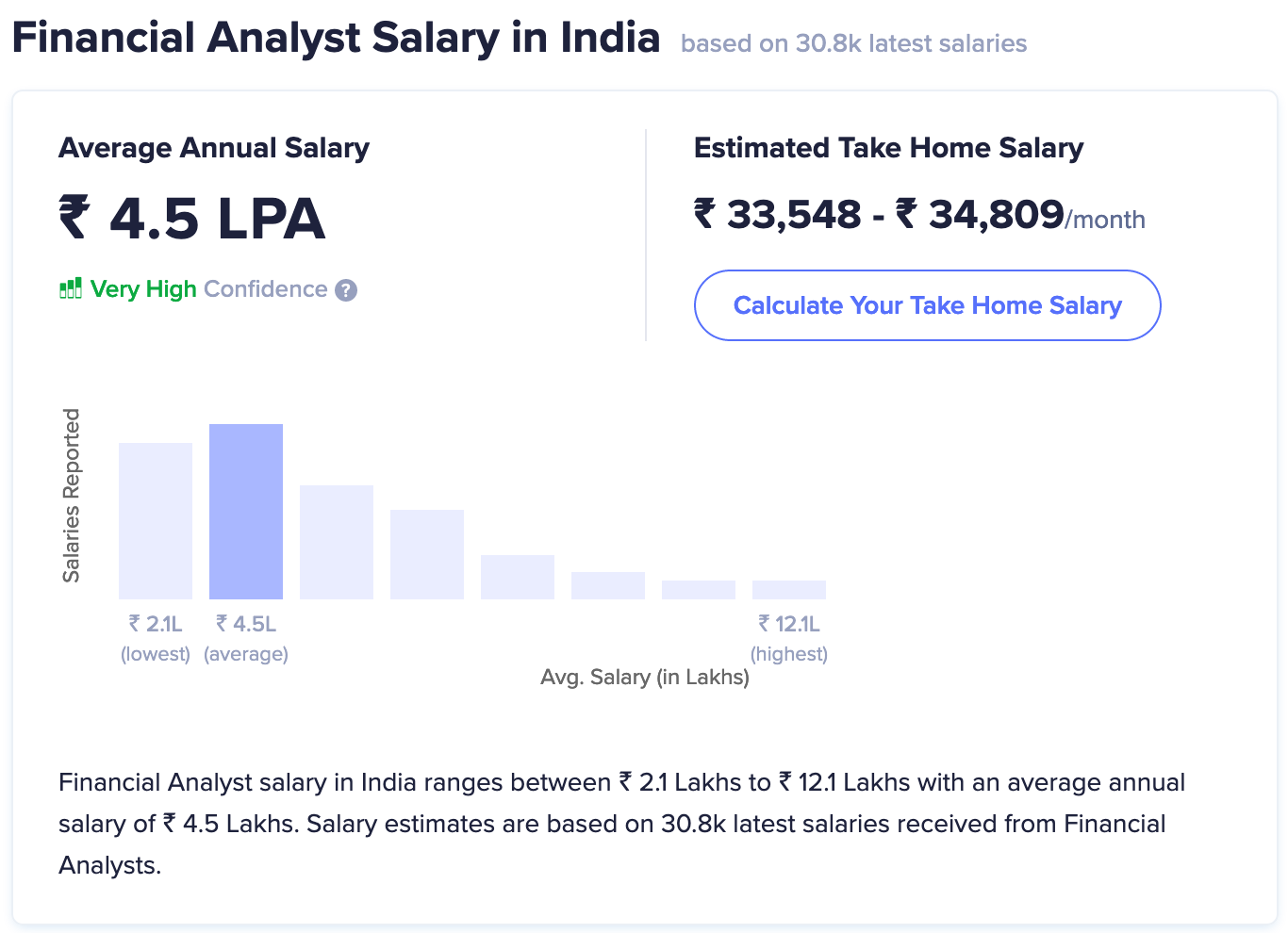

According to the Ambition box, the average salary of a financial analyst in India is four lakhs INR, as shown in the image above. However, the pay scale includes base salary, tips, bonuses, commission profit sharing, and overtime pay.

To increase salary, one must develop various skills and experience through internships. An employer will pay you more if you have pursued a master’s degree.

Financial analysis is one of the top-paid jobs among financial experts. There will be a growth of 5% in the employment rate of financial analysts between 2019 to 2029, faster than the overall average of other sectors.

An entry-level financial analyst with one year of experience can expect to earn total compensation of 3-4 lakhs rupees annually. On the other hand, with 2-5 years experience can expect to make 5-6 lakhs rupees annually.

While a middle-level career financial analyst with 5-9 years of experience can earn 6-7 lakhs annually, on the contrary, with 10-15 years of experience, one can expect 8-9 lakh rupees annually. Lastly, on the highest level, with 20+ years of experience, one can earn an average of 2 million rupees annually.

Demographics opportunities for Financial Analysts

Due to globalisation, many foreign companies are opening subsidiary companies in India. This has provided hew opportunity for skilled and talented financial analysts. Therefore there is a blooming future for an aspiring candidate who has chosen their career as a financial analyst.

According to a quick search on LinkedIn, there will be over 2000 financial analyst job vacancies in India only, which is a high-demand profile.

The employment of financial analysts is expected to surge by 5% between 2019 to 2029, higher than the average of other sectors. This makes India a hotspot for financial analysis with ample opportunities. Their annual package is also expected to grow with growing economic activity.

Top Cities in India for financial analysts

Location plays a vital role in a salary package of a financial analyst. Here is a list with the average annual salary in INR.

- Noida: INR 6,34,768

- Delhi: INR 5,39,288

- Hyderabad: INR 4,94,596

- Mumbai: INR 4.81,834

- Chennai: INR 4,56,197

Top companies with offered annual salaries in India for financial analysts

- The World Bank is approximately INR 15 Lakhs

- DE Shaw is approximately INR 14.5 Lakhs

- Baxter International is approximately INR 13.1 Lakhs

- BT Group is approximately INR 13.1 Lakhs

- Tata Consultancy Services is approximately INR 12.1 Lakhs

Working as a financial analyst outside of India

Financial analysis is a booming and growing field across the globe. As per BLS (Bureau of Labour Statistics) US, there will be a growth of 9% in the employment opportunities of financial and investment analysts from 2021 to 2031. This is faster than the average projected growth for all jobs.

The USA is one of the top countries for a career in finance, as New York City serves as a global financial hub. As per the CFA institute, 66% of CFA are from the USA. After that UK comes next in the queue.

According to Occupational Employment and Wage Statistics, Initially, at an entry-level earning of a financial analyst is approximately 50000 $ annually.The earning of a financial analyst’s salary is about 100000 $ at a top level.

As a home country of the CFA designation, the USA has excellent opportunities to accelerate your career as a financial analyst. Apart from USA and UK, countries like UAE, South East Asian countries, Switzerland, Singapore, and Hong Kong have great demand for financial analysts.

Here is a list of companies that pay the most at the global level

- Ernst & Young [EY] with an annual income of $ 1,25000

- Apple, with an annual income of $ 115,863

- World Bank, with an annual income of $ 106,146

- Stanford University with an annual income of $105,421

- Capital One, with an annual income of $92,688

- US Department of Commerce with an annual income of

- US Department of Homeland Securities with an annual income of $95,822

- Applied Material with an annual income of $103,994

- Liberty Mutual Insurance with an annual income of $101,859

- Salt River Prima-Maricopa Indian Community with an annual income of $107,244

Frequently Asked Questions

What are the other options for a career in the finance and investment market besides financial analysis?

Apart from a financial analyst, the demanding and promising career is offered by;

- Investment banker

- Research Analyst

- Investor and Trader

Can a fresher with no experience start his career as a financial analyst?

Yes, a fresher with no experience starts their career as a financial analyst. One can get an entry-level position in the market without experience. Side by side, one can look to enhance his skill with certifications like CFA.

What do financial analyst interns do?

The responsibilities can vary from company to company. Still, in a general overview, the financial analyst intern will collect data, prepare reports, research trends, analyse performance impact, create financial models, and forecast results. You will contribute to the documentation of processes and the implementation of strategic plans more than work on investment decisions.

What is the salary of a CFA intern?

According to CFA Institute’s official website, the average salary of a CFA intern is ₹8,41,684 per year in India.

Here is the average annual salary of the CFA in India based on level.

- Level 1 cleared CFA can earn 3-4.5 lakhs

- Level 2 cleared CFA can make six lakhs

- Level 3 cleared CFA can make above ten lakhs

Apart from CFA, which other certificate can help you start a career as a financial analyst?

Apart from CFA, one can work as a financial analyst with CA or CS degree. However, with a CA degree, you can’t work outside India as CA is not a global certificate for openings related to the financial market.

Which country is best for the finance profession other than the USA?

For the financial profession, Switzerland is the best country for a high standard of living and a perfect work-life balance. Singapore also offers a high-value pay scale and promising opportunities.

What qualifications do I need to be a financial analyst?

To become a financial analyst, one must start with a bachelor’s degree in finance, accounting or anything related. CFA is the most recommended course for financial analysts, but one can be a financial analyst with CA or CS in India. For booming growth MBA in finance is always advisable.

Is CFA a must to become a financial analyst?

The Chartered Financial Analyst (CFA) is the most recommended course for finance professionals. It consists of three levels; ideally, an individual takes four years to complete this course. The course lays a significant emphasis on portfolio management and investment analysis.

Which is better, CA or CFA, in India?

To answer this, one must evaluate in three terms are

- Opportunities

- Pay scale

- Time duration

In terms of opportunity, CA provides opportunities within a particular geographical location. However, CFA offers global opportunities to work.

If we talk about pay scale, a CFA fresher earns more than a CA fresher. After that, the salary earning entirely depends on skills, a company’s reputation, your position in the industry, etc.

Lastly, a candidate’s duration to become CFA is less than CA.

So on all fronts, CFA is a better choice than CA.

Which is easier, CA or CFA, in India?

As CFA is a global course, CFA is more challenging than CA. So fewer people are applying to the CFA course, so look at the stats for the latest examination result passing ratio of CA is 0.5%, while the passing percentage of CFA is 0.7%. CFA seems easier than CA, but it also depends on who applies for CA and CFA. Every commerce graduate aspires to be a CA in India, but that may not be true for CFA.

Can I become a financial analyst with MBA?

Yes, one can become a financial analyst with MBA. To be a financial analyst, one should hold a bachelor’s degree in a business-related field. An MBA in financial analysis and relevant experience also help you for extraordinary growth. Professional certifications, like the chartered financial analyst (CFA) designation, may fast-track your career.

Can I become a financial analyst without MBA?

Yes, you can become a financial analyst without MBA. To start, you need a bachelor’s degree. However, a CFA and MBA in finance will boom your career path.

Final thought

In short, financial analysis is the most in-demand finance niche. India will be one of the potential markets to start your career as a financial analyst. A financial analyst is the best and growing career path if you have proper education qualifications and competent skills to explore the market. Regularly using up-to-date market knowledge correctly will open a door for a successful analyst.