Are you starting a startup or struggling in your startup? Here I am sharing a complete guide for the startup India Scheme.

Want to know everything about the Startup India scheme by the government of India? You are on the right page if the answer to this question is yes.

The government of India has provided complete support for startups, and here I am sharing a complete guide for the Startup India Scheme to help you with your startup for funding, availing benefits including the incentives.

What is Startup India Scheme?

As per the government of India

Startup India is a flagship initiative of the Government of India, intended to catalyse startup culture and build a strong and inclusive ecosystem for innovation and entrepreneurship in India.

The Startup India Scheme is an initiative launched in January 2016 to foster and support the growth of startups in the country. The goal is to create a nurturing startup ecosystem, encourage entrepreneurship, and promote innovation-driven enterprises.

Additionally, the scheme provides various benefits and incentives to startups to facilitate their development and success.

According to the data on the official website of Startup India,

India has the 3rd largest startup ecosystem in the world; expected to witness YoY(Year On Year) growth of consistent annual growth of 12-15%.

Criteria to apply for a Startup:

To apply for a Startup, you must meet specific eligibility criteria. These criteria are as follows:

Age of the Applicant

Indian citizens aged 18 or above can apply for the scheme.

Age of the Firm

The Date of Incorporation of the company should not exceed ten years

Yearly Turnover

Turnover should be less than INR 100 Crores in previous financial years. An entity shall be considered a startup up to 10 years from incorporation.

Original Entity or Company

The Company or Entity should have been formed initially by the promoters and not by splitting up or reconstructing an existing business.

Innovative and Scalable

The startup should have a plan for developing or improving a product, process, or service and have a scalable business model with a high potential for creating wealth & employment.

However, Companies working towards developing a new product or service can avail of benefits under the Startup-is India policy.

Additionally, the entity should work towards innovation, development, deployment, or commercialisation of new products, processes, or services driven by technology or intellectual property.

Type of a Company

The company or entity should have been incorporated as Pvt. Ltd. Company (as defined in the Companies Act, 2013), LLP (Limited Liability Partnership) under the Limited Liability Partnership Act, 2008 or a Partnership Firm (under section 59 of the Partnership Act, 1932).

Remember that a sole proprietorship firm is not eligible for Startup India Scheme.

For this certificate, you need to apply to the Register of a Company (ROC) or, in the case of a partnership, to apply for registration of your firm with the Registrar of Firms of your area. You must also submit the required documents and fees to the Registrar of Companies or Firms along with the registration application.

The Registration Process

If you are eligible for Startup India Scheme, you must obtain approval from the Department for Promotion of Industry and Internal Trade (DPIIT). Here I am sharing a step-by-step guide for the registration and approval process for a DPIIT certificate.

Step 1: Create an Account

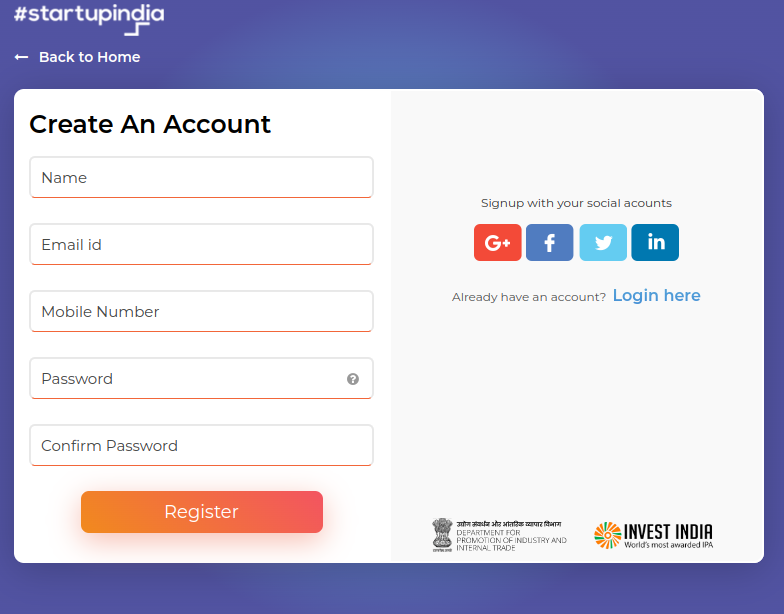

First, you must visit the Startup India Portal (www.startupindia.gov.in) and create an account. Click on the REGISTER button.

On clicking the registration button, you must fill in the required details, such as name, email id, password, etc., as shown in the picture below.

Now you will get OTP (one-time password) on your mobile number to verify your mobile number. Now you will get a pop-up message of ‘ your account has been created.

After you log in, you can complete the profile. It is pretty self-explanatory to fill the profile.

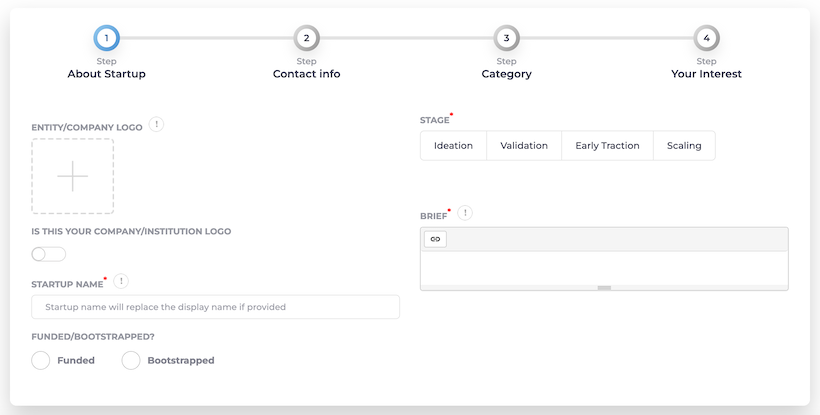

Step 2: Apply for a Start-up

On that page, add the details of your startup. Most of the information is pretty and complete button if you are a new user. In case you are already registered, click on Dashboard and the DPIIT Recognition. Here you need to fill required details for the Start-up recognition page.

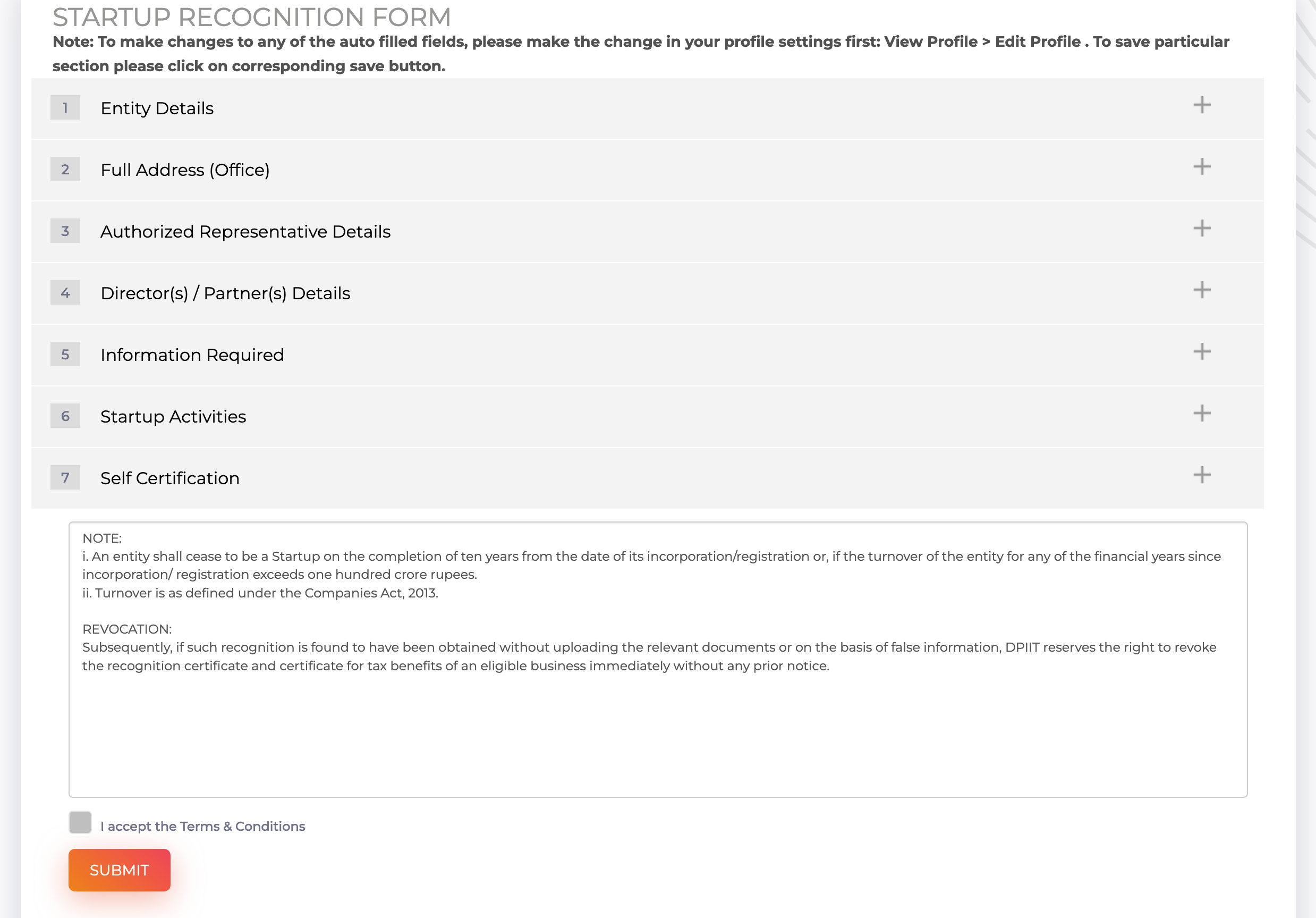

In this form, you must include details such as the entity details, complete address (office), authorised representative details, directors/partner details, information required, startup activities and self-certification.

List of documents needed:

- Incorporation/Registration Certificate

- Director details

- Proof of concept like pitch deck/website link/video (in case of a validation/

early traction/scaling stage startup) respectively - Patent and trademark details (Optional)

- PAN Number

Also, let me share the list of documents not needed at this stage. There is a lot of confusion and misunderstanding regarding these documents. However, you will not need the following documents.

- Letter of Recommendations

- Sanction Letters

- Udyog Aadhar

- MSME Certificate

- GST Certificate

Moreover, if you have any certificates, you can apply if you fulfil the eligibility criteria mentioned above. It’s not like these certificates will make you non-eligible.

Additionally, keep the following details in your mind before applying.

- The idea level- If there is an idea in mind, you can also apply it. Here you use it without any proof of concept and get recognised. Update later when you reach the validation/early traction/scaling stage.

- Got funded or recognised – You need to mention if you have been funded or recognised at any other platform. You need to update your proof of funding, awards, and recognitions received here.

- Applied for Patent/Trademark – If you have applied for a patent or trademark, this can boost your application acceptance criteria. So it is advisable to provide details of your patent, trademark, copyright, and plant variety.

It is essential that you need to be careful in uploading the document. In case it is found that the required document is not uploaded/the wrong document /forged document has been uploaded, then you will be liable to pay the fine of 50% of your paid-up capital of the startup or 25000 INR, whichever is less.

Now you need to click the ” Submit” button. Here you have finished your side work. They will contact you on your registered mobile number or email for additional details.

The specific document requirements may vary depending on the nature of your startup and the application process.

So it is advisable to visit the Startup India Portal (www.startupindia.gov.in) or consult with relevant authorities to get detailed and up-to-date information regarding the required documents for the Startup India Scheme.

Step 3: Get your Identification Number

Generally, it will take two days to process. Once your application is reviewed, they will issue an identification number to monitor the progress of your application.

Step 4: Await Approval

At this time Startup India team will verify and review your application. If you submit complete details in an application, they will issue a certificate of recognition and government certification as a ‘startup’.

However, if the application is not complete, then it will take a longer time. In this case, their team might contact you for further details. Typically, it will take 2-3 weeks for this step.

What is the Cost of DPIIT registration?

There is no cost to register your startup at the Department for Promotion of Industry and Internal Trade (DPIIT). Please note startups won’t have to pay processing, reviewing or submission fees to the Ministry of Commerce and Industry for the DPIIT certificate.

What is the Validity of a Startup India Registration Certificate?

Usually, there are two stages on which the validity of a Startup Certificate depends,

- Ten years after the registration of the company with Startup India

- When your company crosses the 100 Crores turnover

Benefits of the Startup India Scheme

The Startup India Scheme offers several benefits to startups in India. Here are some of the critical advantages and incentives provided under the scheme:

Generally, this recognition helps startup companies to avail different benefits such as access to quality Intellectual Property Services and resources, relaxation in public procurement norms, easy winding of company, access to Fund of Funds, self-certification under labour and environment laws and tax exemption on investment above fair market value.

Tax Exemptions:

Eligible startups can avail of tax benefits for a specific period, which include:

1. Income Tax Exemption:

Usually, startups can avail themselves of income tax exemption for three consecutive financial years out of their first ten years of operation, provided they meet certain conditions. This exemption is available under Section 80-IAC of the Income Tax Act, 1961.

It applies to startups that are recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) and meet the eligibility criteria

2. Capital Gains Tax Exemption:

Startups are eligible for capital gains tax exemption if they invest their capital gains in specified funds recognized by the government. The exemption is provided under Section 54GB of the Income Tax Act, 1961. It applies when a startup sells its assets and reinvests the proceeds into an eligible fund within a specified period.

While these tax exemptions are available, startups must comply with tax laws, maintain proper records, and fulfil other compliance requirements.

Additionally, tax laws and exemptions can change over time, so it’s advisable to consult with a tax professional or seek guidance from relevant authorities to ensure compliance with the latest regulations and benefits available under the Startup India Program.

3. Tax Exemption for Investments by Eligible Investors:

Investments made by eligible investors, including Category I and Category II Alternative Investment Funds (AIFs), into eligible startups are exempt from the applicability of the angel tax provision. This provision helps startups attract investments without facing tax implications.

Self-Certification under Labour and Environmental Law:

Startups can self-certify their compliance with nine labour and environmental laws for five years from incorporation, reducing their regulatory burden.

After obtaining the DPIIT Certificate of Recognition for Startups, the entity can self-certify compliance under 3 Environmental and 6 Labour Laws.

Intellectual Property Rights (IPR) Support:

The scheme provides financial and legal assistance for filing patents, trademarks, and designs. Indeed startups can avail of expedited examination of patent applications, reducing the time for approval.

Funding Support:

The government has established the Fund of Funds for Startups (FFS) with a corpus of INR 10,000 crore (approximately $1.35 billion) to support startups. The FFS invests in SEBI-registered venture capital funds, which invest in startups.

Fast-Track Exit:

Startups can avail of a simplified and fast-track exit process, allowing them to wind up their operations within 90 days, minimizing the risks associated with entrepreneurship.

Public Procurement Relaxations:

Startups have relaxed eligibility criteria and preferences in public procurement processes. They can participate in government tenders without requiring prior experience or turnover, giving them access to government contracts.

Networking and Collaboration:

The scheme promotes networking, collaboration, and knowledge-sharing among startups, investors, industry experts, and government stakeholders through initiatives like the Startup India Hub, Startup India Learning Program, and various startup events and summits.

Incubation and Acceleration Support:

Startups have access to incubation centres, innovation labs, research parks, and mentorship programs established under the scheme. These facilities provide startup infrastructure, guidance, mentorship, and networking opportunities.

Skill Development and Training:

The scheme focuses on enhancing the skills of entrepreneurs and startup employees through skill development programs, workshops, and training sessions.

Faster Patent Examination:

Startups can avail themselves of expedited examination of patent applications. This helps secure patents faster, protect their intellectual property, and enable them to commercialize innovations more efficiently.

International Exposure and Partnerships:

Startups can participate in international events, conferences, and delegations organized under the scheme, which provide exposure to global markets, investors, and potential collaborators.

Recognition and Branding:

Startups recognized under the scheme receive a “Certificate of Recognition” and can use the Startup India logo on their products, websites, and marketing materials. This recognition enhances their credibility and visibility.

Government Procurement:

Startups can participate in government tenders and procurements, opening opportunities to secure government contracts. Besides, the government has also introduced a 25% reservation for startups in public procurement, promoting their inclusion in government projects.

It’s important to note that the benefits and incentives may vary based on the eligibility criteria and specific programs implemented under the Startup India Scheme.

So Entrepreneurs are advised to visit the Startup India Portal (www.startupindia.gov.in) and consult with relevant authorities to understand and avail of the benefits applicable to their startups.

Final Thoughts

In short, the Startup India scheme will constantly guide your idea and business. This scheme can boost your growth to different levels.

The Startup India Initiative has successfully helped the startup ecosystem in India, with over 3,700 startups registered on the Startup India Hub and over ₹1,000 crores through the Startup India Seed Fund.